Coronavirus Advertising Trends Explained

As we head into the middle of the Coronavirus COVID-19 epidemic, advertisers, publishers and adops professionals are left wondering what the future of the digital media ecosystem holds during and after the pandemic. What are the most important coronavirus advertising trends and how will they affect the industry?

While it is still early to understand the long term implications for digital media, a few companies are already compiling data on how coranavirus is affecting CPM (Cost Per 1,000 impression) rates.

Many AdTech companies are reviewing their data to provide insights on COVID-19. SetupAd, a top publisher monetization company gives their take in a recent blog post.

Related Article: Check out our Review of SetupAd

Let’s take a look at the early industry data compiled by adtech companies.

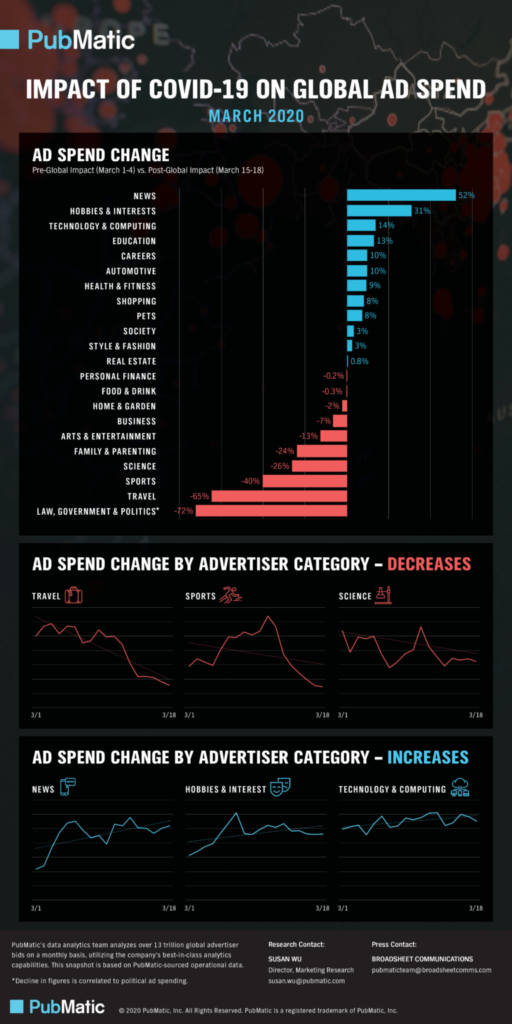

Impact Of Covid-19 On Global Ad Spend

PubMatic released a solid infographic in early March. showing how ad spend has shifted on their platform. If you think about it, a lot of the coronavirus advertising trends (industry specific increases and decreases) outlined by PubMatic below make sense.

Increases in ad spend due to COVID-19

Because of the explosion coronavirus coverage in March, ad dollars have increased in the following categories: News, Hobbies/Interests, Technology/Computing, Education, Careers, Auto, Health and Fitness, Shopping Pets, Society and slightly in Style/Fasion and Real Estate.

Decreases in Ad Spend Due to COVID-19

On the contrary, there has been a decrease in spend in the following categories: Law, Government/Politics, Travel, Sports, Science, Family/Parenting, Arts/Entertainment, Business, Home/Garden, Food/Drink and Personal Finance.

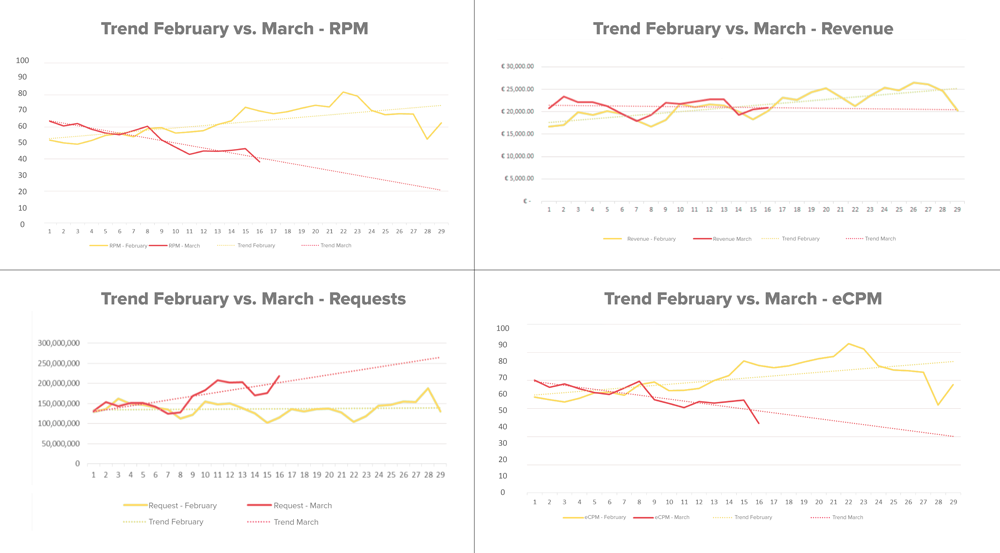

Coronavirus Impact on CPMs

YieldBird released a trove of anonymous publisher data showing the coronavirus advertising trends in their own publisher marketplace. What you can see is a downward trend of both CPMs and revenue in march compared to February.

There are a few reasons for the decreased CPM and revenue due to COVID-19.

More Impressions – People are always at home.

Due to social distancing – the practice of avoiding human contact and staying at home, more people are consuming content on their devices. People are constantly looking for updates on the pandemic, checking the news or looking for entertainment to escape the unsettling reality.

There is not much else to do besides look at content so naturally we are seeing an enormous increase in ad impressions. unfortunately for publishers who are covering the news and increasing their web traffic, the increase in supply is not necessarily correlating to an increase in revenue.

Less advertisers – Lower CPMs and less revenue.

As the economy sinks into a recession, and possibly a depression, advertisers overall are holding their ad spend, especially in specific industries that are basically non exist ant at the moment.

Think about it, if you are a cruise line there is no point in advertising as all cruise lines have closed until further notice. Many of the largest brand advertisers have pulled their spend until further notice and the loss in ad spend ultimately trickles down to the end publisher.

There is potentially a ton of new supply out there but little demand to fill the ad request.

Digital Media Companies are helping the cause

While advertising is inherently known to be “evil” many adtech companies are stepping up to the plate and doing their part to spread awareness about Coronavirus and help save lives.

For example: Ad Council a nonprofit advertising organization, partnered with the United States government, public health officials, board member companies, major media networks and digital platforms to launch Coronavirus PSA ads across the internet to provide messaging to the public.

Will digital publishers survive the coronavirus crisis?

We think so, but times are going to be tough and publishers will need to be extremely lean and efficient. Huge digital media companies are already laying off non-essential employees, getting rid of their office spaces and focusing on the reduction of unprofitable deals with ad networks, agencies, DSPs and other vendors that provide little value.

Time will tell what happens to the online advertising industry.